Enhancements

FAQs

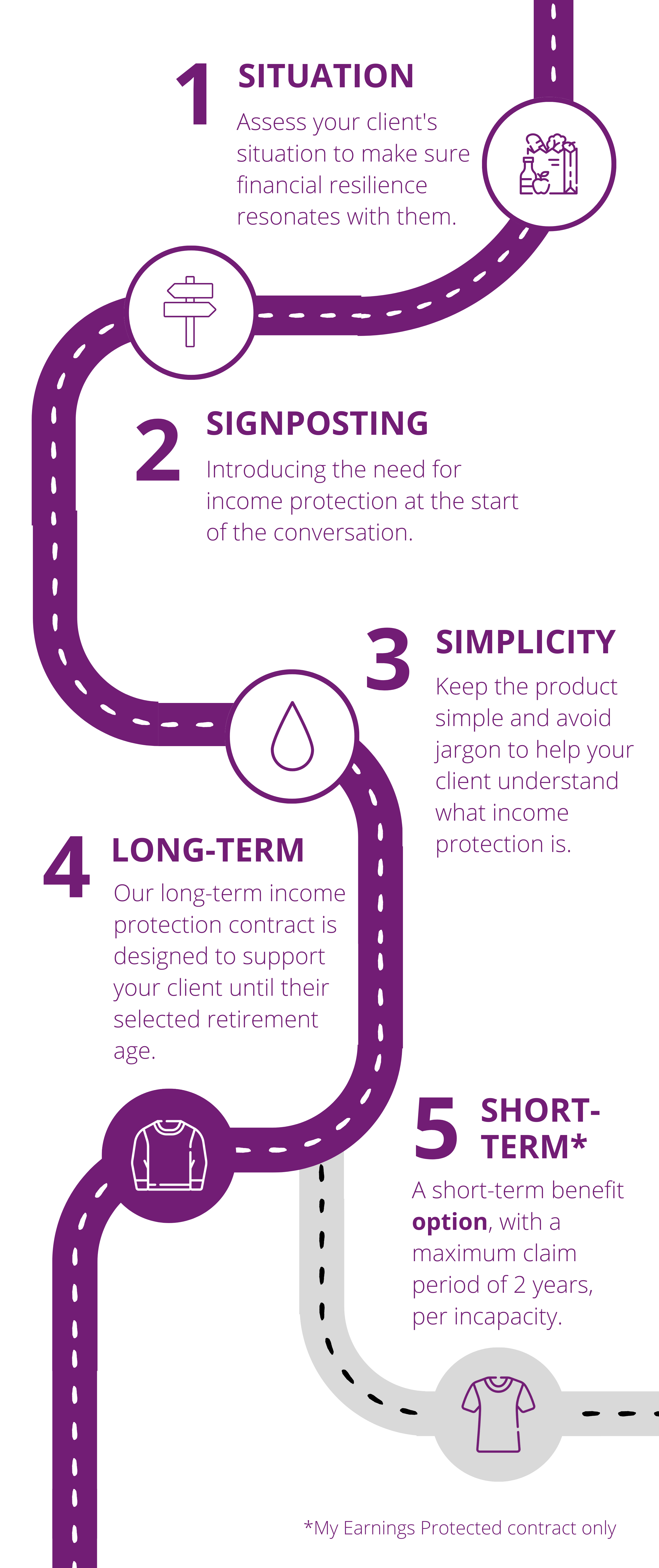

If your client’s application has a start date after 20 June 2023 then Short Term will be an option available to them, providing they have not received an underwriting decision. If the application has a start date before 20 June 2023, then the simplest thing to do is start a new application for your client, however our motor sports exclusion will then apply. Please let us know if this is your intention, as we may need to make some changes to avoid any problems with the new application.

Currently, it is not possible to amend an existing contract to support Short Term, however Members are able to cancel their existing contract and re-apply for a new contract under new terms and conditions. Commission clawback would apply to the cancelled contract where applicable. Please let us know if this is your intention, as we may need to make some changes to avoid any problems with the new application.

No, this makes no difference to the underwriting of the application.

Your client’s application can be started on any date they choose for both claim periods.

The direct debit dates are the same for both Long Term and Short Term (i.e. 1st, 7th, 14th, 21st & 26th of the month).

Severe Injury Cover requirements are the same for Long Term and Short Term. However, for Short Term the benefit payable will be restricted to 2 years.

My Extra Benefits will have no restrictions and is not currently affected by the selected claim period.

The commission amount is based on the premium, and the percentage amount is the same for both Long Term and Short Term.

For Members who have applied for cover on or after 20 June 2023, any disabling condition arising from the Member’s participation in any form of motor sport (whether competitively or not) shall also be an excluded condition.

Please note this relates to Income Assured Enhanced and My Earnings Protected (Full Term and Short Term Benefit).

Any applications started before 20 June 2023, will not include the motor sports exclusion. Applications started on or after the 20th will include the motor sports exclusion. If a quote is started before the 20th, but they only click to apply after on/after 20 June, it will include the motor sports exclusion. The quote isn’t enough to secure cover.

The exclusion is based on the date the actual application process starts.

For contracts issued before 20 June 2023, the motor sports standard exclusion won’t apply even if a contract amendment is made.

Your client must be back to work on full duties for at least 26 weeks and have been free of the disabling condition before they can claim for same illness or incapacity again. Their deferred period will also apply.

We're here to help

Call us

0800 587 5098